Business Checklists

Get step-by-step directions on launching a storefront, launching a home-based business, or growing your existing business.

Home-Based Business Info

A home-based business is a small business that is based within a residence, such as a home office. The business owner both resides and operates a business within the same building or dwelling. Individuals who own or operate a business from a residence inside the City are required to obtain a City of Tacoma Business License and a Home Occupation License to legally operate. Home-based businesses are typically small-scale businesses that don’t have frequent on site customer traffic.

My Checklist

Choose a business structure

There are different types of business structures, each with its own benefits and restraints. The most common types include:

- Sole proprietorship

- General Partnership

- Limited Liability Company

- Corporation

For more information about the different business structures you can choose from, please review the Washington Small Business Guide.

My Checklist

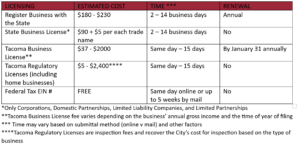

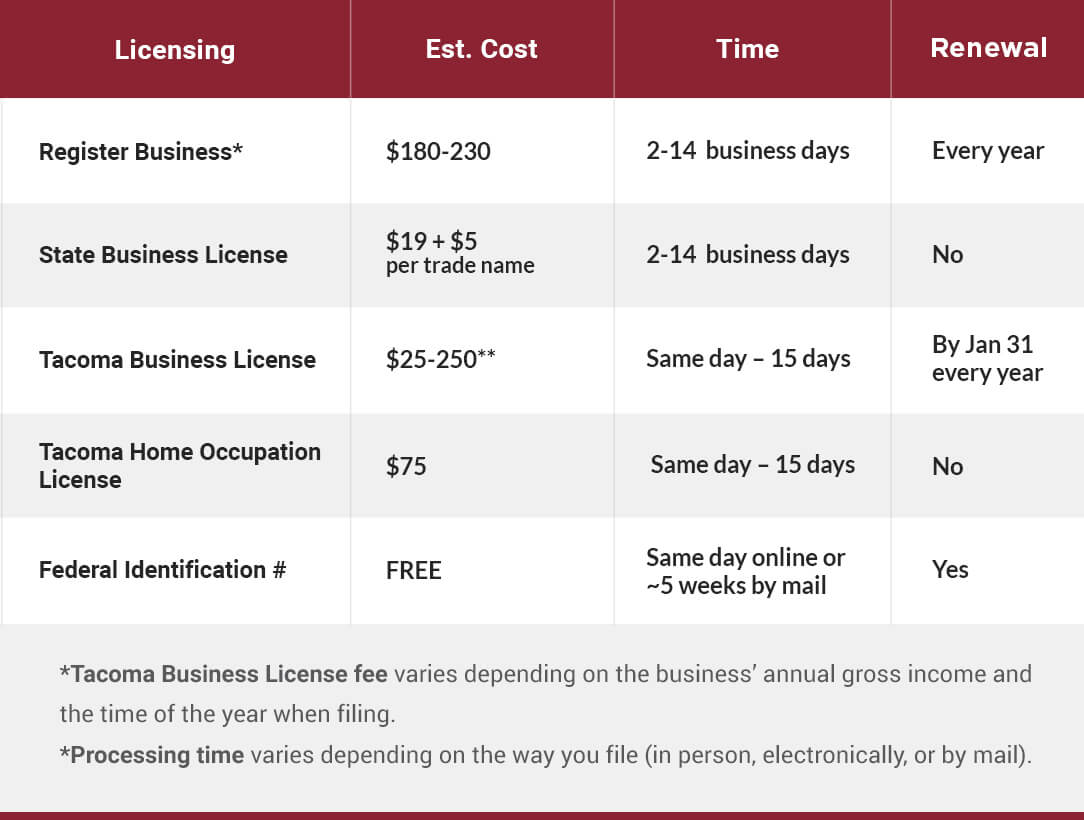

Licensing

When opening a business in Tacoma one should make sure to be in compliance with State Government, City Government, and the Federal Government.

Please note: All food establishments operating in Pierce County must be licensed or permitted by Tacoma-Pierce County Health Department (TPCHD) unless specifically exempted by code.

The table below list necessary licenses in order to be in compliance with governmental agencies. Additional licenses may be needed depending on the type of business you wish to operate.

State of Washington

Registering Business with the State of Washington (only for Corporations, Limited Liabilities Companies, and Limited Partnerships)

*Skip this step if your business is a sole proprietorship or general partnership.

Corporations & Limited Liability companies need to register with Washington Secretary of State first to obtain a Unified Business Information (UBI) number. After obtaining a UBI from the WA Secretary of State, Corporations, Limited Liabilities Companies, and Limited Partnerships, will need to file the State Business License. Make sure to use the UBI obtained from the WA Secretary of State on the WA Business License Application.

Filing your State Business License

All businesses are required to obtain the Washington State Business License if the business meets one or more of the following criteria:

- Your business grosses $12,000 or more per year.

- You’re doing business using a name other than your full legal name.

- You plan to hire employees within the next 90 days.

- You sell a product or provide a service that is taxable.

- Your business has specialty licenses available through the Business Licensing Service.

To obtain your Washington Business License file the Business License Application.

When you file your Washington Business License Application, be prepared to address the following:

- General business information, including physical location and ownership.

- A rough estimate of your expected gross annual revenues.

- Whether you intend to hire employees within 90 days of start-up (if you check you will hire employees, this will trigger reporting with WA Labor and Industries and the WA Employment Security Department).

- Whether you will want optional workers’ compensation coverage for business owners. If owners don’t opt in, they won’t be covered for on-the-job injuries.

City of Tacoma

Filing your City of Tacoma Business License

Generally, all businesses operating in or soliciting business in the corporate city limits of Tacoma are required to be registered and licensed with Tacoma. You need to register with the City if you are located within the City’s limits, solicit, or conduct business in Tacoma, whether directly or through a representative, or do business with the City of Tacoma through contracts. If you are unsure whether or not your business is required to register, contact the Tax and License Department at (253) 591-5252.

How to Apply

There are three ways to apply for registration and business license:

- By Mail – To apply by mail, download the Application for Registration and Business License form from the City of Tacoma Tax and License site. Complete the form and mail it to the address listed. For Rental businesses, please make sure you are using the Rental Property Owner Guide, available at the page linked above.

- In Person – To apply in person, visit our office at 747 Market St., Room 212, Tacoma, WA 98402-3770. You can complete the applications, pay the license fee and in most cases receive your business license the same day. Please allow 45 to 60 minutes to process a new business license application. Applications received after 4 PM will be accepted, however, may not be processed the same day.

- Online – New businesses can now apply for their City of Tacoma business license online using FileLocal, your one-stop for local business licensing and tax filing. Online user fees apply. Please allow three to five business days to process your application.

Filing your City of Tacoma Home Occupation License

In addition to having obtained a Tacoma Business License, you will need to obtain a Home Occupation License. The Home Occupation license is required to operate your home-based business regardless of the amount of revenue the business generates and whether or not the business is a part-time or full-time enterprise. The Home Occupation license fee is a one-time only fee of $75, as long as you do not change the nature of your business activity. If you change the type of services or goods you are providing for your business, you will be subject to another application and processing fee of $75.

For more information on the Home Occupation License please review this Tip Sheet or contact the Tax and License Department at (253) 591-5252.

Additional City of Tacoma Licenses

Regulatory Licenses

Certain business activities require a Regulatory License in addition to the Tacoma business license. To find out if your business needs an additional license from the City of Tacoma, please contact the Tax and Licensing Division COT web page

Do you plan to have a Rental Business?

Any person who rents or leases out real property within the city limits of Tacoma must obtain a rental business license, please visit the City of Tacoma page here for more details: Rental Business License – City of Tacoma

Federal Government

Apply for a Federal Tax Number with the IRS

You must obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) unless your business is a sole proprietorship or one-owner LLC and you won’t have employees. In that case, you can use your Social Security Number as the business’s federal identification number, although many business owners choose not to for confidentiality reasons. EIN is also known as a Federal Tax Identification Number and you can obtain it the same day if you apply online. There is no charge to file for an EIN with the IRS. It may take up to 5 weeks if you apply by mail.

When filing for your EIN number you will be asked the type of business structure you wish to file under. The IRS doesn’t recognize LLCs as a classification for tax purposes. LLCs default to sole proprietorship taxation if one owner, and partnership taxation if more than one owner. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes through IRS Form 8832. If you wish to be treated as an S corporation, you must complete Form 2553 – Election by a Small Business Corporation within 75 days of forming your business. Consult your tax professional for further information and advice.

My Checklist

Business property info

If you are planning to open up a store, restaurant, office or other business property you should make sure to be in full compliance with all laws and regulations. Besides needing state and city licenses to operate your business in Tacoma, you will need permits for construction or remodeling of your business property.

Before leasing or buying business property please check with the City’s Planning and Development Services Department (Tacoma Permits or 253-591-5030) that the zoning is proper for the type of business you plan to conduct and that the building meets codes for occupancy. Certain business investments or conversions from one business type to another may trigger certain City permits and offsite improvements.

The City of Tacoma Planning and Development Services Department can help provide guidance with opening your business property to avoid surprises. Each business owner is required to be in full compliance whether or not the information is included in this site or disclosed by the landlord or seller.

Checklist for Brick and Mortar Opportunities

My Checklist

Zoning check

(DON’T SIGN A LEASE BEFORE CHECKING ZONING)

Choosing the right place to start your business makes all the difference in the world, whether you’re starting a restaurant or opening an auto parts store. Before deciding on a location, signing a lease, renovating or purchasing a building you will want to make sure that your business location is the right fit.

Check with the City’s Planning and Development Services Department on current zoning, land use, allowable uses and requirements for a particular location. The Planning and Development Services Department also issues building permits and sign permits. Obtaining information before your make any key decisions will likely save you time, money and possible headaches further down the road.

The Planning and Development Services also offers an Interactive Zoning Map to help you with your decision. This map contains detailed information regarding site zoning including allowed uses, setbacks, minimum lot area, and height.

Planning and Development Services Department

Address:

747 Market Street, 3rd Floor

Tacoma, WA 98402

Visit the Planning and Development Services Department website

Permit Services: 253.591.5030

My Checklist

Pre-application meetings

(REVIEW PLANS WITH THE CITY)

Set up a pre-application meeting to check on your plans with the City. Pre-application meetings are intended to provide applicants with the opportunity to present development proposals, discuss applicable codes, ask questions, and determine the requirements for a complete application prior to the actual permit intake process.

A pre-application meeting also allows Planning and Development Services (PDS) staff to become familiar with project elements prior to a complete, in-depth review. There are different types of meetings offered: coaching, scoping, and land use. Meeting details are listed on this tip sheet. For any questions, please call Planning and Development Services at (253) 591-5030.

Request a Pre-Application Meeting

Requests for pre-application meetings can be submitted online by the applicant.

- Go to TacomaPermits.org and select Apply for Permits – this will redirect you to the ACA webpage

- Log-in to your account (If you have not registered for an account you will need to do so – see Getting Started Guide)

- Select Permits

- Read and check the disclaimer and select Continue Application

- Select Pre-application Request

- Fill out all available information and attach PDF documents

Once you have submitted your request, you will be contacted by staff (normally within two business days) to schedule your meeting.

My Checklist

Choose a business structure

There are different types of business structures, each with benefits and restraints. The most common types include:

- Sole proprietorship

- General Partnership

- Limited Liability Company

- Corporation

For more information about the different business structures you can choose from, please review the Washington Small Business Guide.

My Checklist

Licensing

When opening a business in Tacoma one should make sure to be in compliance with State Government, City Government, and the Federal Government.

Please note: All food establishments operating in Pierce County must be licensed or permitted by Tacoma-Pierce County Health Department (TPCHD) unless specifically exempted by code.

The table below list necessary licenses in order to be in compliance with governmental agencies. Additional licenses may be needed depending on the type of business you wish to operate.

State of Washington

Registering Business with the State of Washington (only for Corporations, Limited Liabilities Companies, and Limited Partnerships)

*Skip this step if your business is a sole proprietorship or general partnership.

Corporations & Limited Liability companies need to register with Washington Secretary of State first to obtain a Unified Business Information (UBI) number. After obtaining a UBI from the WA Secretary of State, Corporations, Limited Liabilities Companies, and Limited Partnerships, will need to file the State Business License. Make sure to use the UBI obtained from the WA Secretary of State on the WA Business License Application.

Filing your State Business License

All businesses are required to obtain the Washington State Business License if the business meets one or more of the following criteria:

- Your business grosses $12,000 or more per year.

- You’re doing business using a name other than your full legal name.

- You plan to hire employees within the next 90 days.

- You sell a product or provide a service that is taxable.

- Your business has specialty licenses available through the Business Licensing Service.

To obtain your Washington Business License file the Business License Application.

When you file your Washington Business License Application, be prepared to address the following:

- General business information, including physical location and ownership.

- A rough estimate of your expected gross annual revenues.

- Whether you intend to hire employees within 90 days of start-up (if you check you will hire employees, this will trigger reporting with WA Labor and Industries and the WA Employment Security Department).

- Whether you will want optional workers’ compensation coverage for business owners. If owners don’t opt in, they won’t be covered for on-the-job injuries.

City of Tacoma

Filing your City of Tacoma Business License

Generally, all businesses operating in or soliciting business in the corporate city limits of Tacoma are required to be registered and licensed with Tacoma. You need to register with the City if you are located within the City’s limits, solicit, or conduct business in Tacoma, whether directly or through a representative, or do business with the City of Tacoma through contracts. If you are unsure whether or not your business is required to register, contact the Tax and License Department at (253) 591-5252.

How to Apply

There are three ways to apply for registration and business license:

- By Mail – To apply by mail, visit the City of Tacoma Tax and License site and download the Application for Registration and Business License form. Complete the form and mail it to the address listed. For Rental business activity only download the Registration and Rental License Agreement and mail to the address listed. Please allow ten to 15 business days to process.

- In Person – To apply in person, visit our office at 747 Market St., Room 212, Tacoma, WA 98402-3770. You can complete the applications, pay the license fee and in most cases receive your business license the same day. Please allow 45 to 60 minutes to process a new business license application. Applications received after 4 PM will be accepted, however, may not be processed the same day.

- Online – New businesses can now apply for their City of Tacoma business license online using FileLocal, your one-stop for local business licensing and tax filing. Online user fees apply. Please allow three to five business days to process your application.

Filing your City of Tacoma Home Occupation License

In addition to having obtained a Tacoma Business License, you will need to obtain a Home Occupation License. The Home Occupation license is required to operate your home-based business regardless of the amount of revenue the business generates and whether or not the business is a part-time or full-time enterprise. The Home Occupation license fee is a one-time only fee of $75, as long as you do not change the nature of your business activity. If you change the type of services or goods you are providing for your business, you will be subject to another application and processing fee of $75.

For more information on the Home Occupation License please review this Tip Sheet or contact the Tax and License Department at (253) 591-5252.

To apply for a Tacoma Home Occupation license, complete and return the Home Occupation Agreement to:

City of Tacoma (Tax & License Division)

747 Market Street, Room 212

Tacoma, WA 98402-3770

Additional City of Tacoma Licenses

Regulatory Licenses

Certain business activities require a Regulatory Licenses in addition to the Tacoma business license. For more information visit: COT Business License Resources

Do you plan to have a Rental Business?

Any person who rents or leases out real property within the city limits of Tacoma must obtain a rental business license. For more details on this license please visit: COT – Rental Business License

Federal Government

Apply for a Federal Tax Number with the IRS

You must obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) unless your business is a sole proprietorship or one-owner LLC and you won’t have employees. In that case, you can use your Social Security Number as the business’s federal identification number, although many business owners choose not to for confidentiality reasons. EIN is also known as a Federal Tax Identification Number and you can obtain it the same day if you apply online. There is no charge to file for an EIN with the IRS. It may take up to 5 weeks if you apply by mail.

When filing for your EIN number you will be asked the type of business structure you wish to file under. The IRS doesn’t recognize LLCs as a classification for tax purposes. LLCs default to sole proprietorship taxation if one owner and partnership taxation if more than one owner. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes through IRS Form 8832. If you wish to be treated as an S corporation, you must complete Form 2553 – Election by a Small Business Corporation within 75 days of forming your business. Consult your tax professional for further information and advice.

My Checklist

Permits

The City of Tacoma provides pre-development consultations, plan reviews, permitting and inspections for commercial, industrial, and site related development. The City of Tacoma Planning and Development Services can help you obtain the necessary permits to perform the necessary construction for physical alteration of your business property.

Tacoma Permits Online Permit System

The City’s new permitting portal, Tacoma Permits, makes it easier to apply, pay for and obtain permits from the City of Tacoma—all online. There are also tip sheets to answer all your frequently asked questions. The site also offers a fee estimator tool to help you estimate permit fees based on the work you plan on doing to the building.

Visit Tacoma Permits to obtain building permits for any new construction or modification to an existing building.

Tenant Improvements

A Tenant Improvement is an alteration made to the interior of a commercial or industrial building to accommodate the needs of a tenant, such as adding or altering floor and wall coverings, ceilings, partitions, air conditioning, fire protection, and security. For all Tenant Improvements, the permit requirements depend on the scope of work proposed.

Restaurants

A Tenant Improvement to convert a building into a restaurant will have additional requirements. Please refer to

Sign Permits

If you are looking to install a new sign or modify an existing sign (even signs painted on buildings), you are required to get a sign permit from the City of Tacoma before installation. The Tacoma Municipal Code (TMC) limits the number, size and height of signs allowed on a site, so make sure to check your limits before manufacturing your sign! Please note that the TMC does not allow signs to be attached to fences, telephone poles or traffic control devices. Also, only real estate or political signs may be placed within the street rights-of-way.

If you have specific questions about sign regulations please call the Planning and Development Services at (253) 591-5030.

Illuminated Signs

Illuminated signs also require an electrical permit from Tacoma Power.

Sign Installation

If you need to work in the city right-of-way (sidewalk, parking strip, etc.) while installing your sign you will need a barricade permit, which can be obtained through the Planning and Development Services Department at (253) 591-5030.

Sidewalk A-Frame Boards

Most commercial areas of the City allow a business to have one sidewalk A-frame board located on private property (e.g. not on the sidewalk or planting strip), provided that it meets TMC criteria: signs must not exceed 12 square feet or four feet in height. Signs cannot be placed on sidewalks less than 12 feet in width. No permit is needed but a business would be subject to enforcement if it exceeds the one sign allowance. Please see TMC 13.06.520 or contact a permit specialist at (253) 591-5030 for more answers.

My Checklist

Inspections

(Ensure your safety)

Inspections must occur after the construction phase to assure your business is meeting City of Tacoma’s safety standards. Inspections can be scheduled for the next business day if received by 3 pm. For more information on inspections visit the portal, Tacoma Permits.

How to Schedule An Inspection:

- Schedule inspections online at Tacoma Permits (ACA)

- Schedule inspections by phone (253) 573-2587

- Find out which inspection type is needed

Electrical Inspections: Contact Electrical Inspections or call (253) 502-8277 to schedule electrical inspections.

Tacoma Fire Department Building Inspection

The Tacoma Fire Department conducts inspections of the City’s commercial buildings to ensure compliance with the adopted Fire Code. These annual inspections are one of the lowest-cost ways to help protect your property and the safety of your employees and visitors.

For more information about the program and to find out the cost of the inspection fee please visit the Tacoma Fire Department page.

For more information please contact the Tacoma Fire Prevention Division at (253) 591-5740 or by through e-mail at [email protected]

Certificate of Occupancy

In order for a business to operate in a building, that building must have a certificate of occupancy issued by the City of Tacoma Building Official for the business’s proposed use. As required by the City’s adopted Building Codes, the certificate of occupancy is issued based on many factors, including proposed occupancy type, occupant load, type of construction of the building, and conformance with all other provisions of the City’s Building Codes.

My Checklist

Hire employees

Don’t hesitate to delegate the workload and invest in good staff that can help you do more so you can grow your business effectively. If you need extra staff, learn the difference between hiring an independent contractor and an employee at the State’s Department of Revenue hiring page. If you decide to hire employees, you will be required to fill out a new Washington State Business Application and register them for workers’ compensation and unemployment insurance. Visit the Washington State Department of Labor and Industries page for detailed information if you plan to hire teen workers. If you plan to hire employees who are under 18, you must file for a Minor Work Permit. To find qualified workers, consider Workforce Explorer to research wage information and post job openings. Employers are required to follow state workplace wage and hour requirements.

NOTE: You must report your newly hired employees to the Department of Social and Health Services within 20 days of hire.

Workers’ compensation and unemployment insurance

All businesses hiring employees are required to register for workers’ compensation and unemployment insurance. By completing the Business License Application, you’ll be registered for workers’ compensation at the Department of Labor and Industries and unemployment insurance at the Employment Security Department.

After filing your application, the Department of Labor and Industries and the Employment Security Department will send you information about employee quarterly report forms.

Federal Requirements

The Internal Revenue Service requires you to collect employee information for your records and for required reporting. The Dept. of Homeland Security requires Form I-9, which must be completed within 3 days of hire. You also need to deposit and report federal employment taxes.

My Checklist

Funding

Now that you have an established business and have demonstrated that your business is fiscally sound, you might consider obtaining a loan or other capital to grow your business.

To qualify for a business loan, owners typically must demonstrate the five “Cs” of lending: capital (owner’s monetary contribution to loan), capacity (ability to repay debt), collateral (assets in case of default), cash flow (ability to pay business costs while leaving sufficient operating cash) and character (owner’s experience and financial credit).

Tips

Before obtaining a loan consider familiarizing yourself with loan terminology, attending workshops on financial skills, and learning about lenders’ criteria. It is recommended that you have financial statements from your business to show that your business is profitable and capable of repaying the loan.

Sources of Financing

Your local bank or credit union

You’re in a good position to apply for a loan now because most banks only provide funding to businesses with a track record of two or more years. If you can demonstrate your business has value and tangible assets as collateral, banks are more interested in doing business with you.

City of Tacoma Small Business Loan Fund Program

The City of Tacoma’s Community & Economic Development Department, in coordination with the Tacoma Community Redevelopment Authority (TCRA), offers the Small Business Loan Fund Program. The program is designed to provide the funding necessary for a business to establish or expand. This program provides gap financing, which is used in combination with the borrower’s other financial resources. Other financial resources should include a senior lender and equity investment. In all cases, borrowers must demonstrate the ability to repay the loan and provide sufficient collateral to secure the loan. The minimum loan amount offered through the loan fund program is $25,000 and the maximum loan amount available is $300,000. Loans carry a fixed interest rate that is the lower of 4% or 75% of the prime rate listed in the Wall Street Journal.

For information on City of Tacoma business loans, contact Deirdre Patterson. 253-591-5621. [email protected]

Grow America Fund (GAF)

The National Development Council operates this SBA 7a program through its lending arm, Grow America Fund. GAF has no stipulations that require a business to not be able to acquire funds from a traditional lender or other lending channels. The GAF provides loans to established businesses (with $100,000 – $2 million in annual revenue) that are unable to secure financing on reasonable terms through normal lending channels. As with most business loans, the owner must provide equity and show the ability to repay the loan.

City of Tacoma Historic Rehabilitation and Repair Loan

The Historic Rehabilitation and Repair Loan Program (HRRLP) is designed to encourage the rehabilitation, preservation and adaptive reuse of commercial and retail buildings that are listed on the Tacoma Register of Historic Places. This program provides gap financing, which is used in combination with the borrower’s other financial resources. Loan amounts range from $20,000 to $100,000, with a fixed interest rate equal to the 10-year U.S. Treasury Note plus 1%. The maximum loan term is 10 years. Loan proceeds can be used for envelope improvements such as windows, doors, paint, awnings, security alarms, signage, light fixtures and other exterior enhancements made to historic commercial buildings. Proceeds can also be used to address the building’s plumbing, electrical or mechanical systems. Click here for more information.

Pierce County Small Business Loans

Pierce County administers several business loan programs, including microloans and loans for established businesses. For more details visit: Business Assistance and Information – Pierce County

BusinessImpactNW

BusinessImpactNW will offer loans to startups. SBA loan amounts range from $2,500 to $50,000. Non-SBA loans range from $2,500 – $100,000. BIN finances equipment; furniture and fixtures; manufacturing and technology-based production needs; working capital; purchase or tenant improvements to commercial property; franchises; cash flow restructuring; and more. BIN has a Veterans specific loan program and a Women’s Business Center.

Address: 1437 S Jackson Street, Seattle, WA 98144

Website: www.businessimpactnw.org

CRAFT3 (formerly Enterprise Cascadia)

Craft3 offers loans to low-income, minority, women or immigrant-owned businesses, non-profits, and businesses that create family wage jobs. Loans are available for commercial real estate, start-ups and expansions, working capital, energy-efficiency work, acquisitions, inventory, fixtures, equipment and related business property. Start-up loan amounts range from $10,000 to $250,000.Craft3 has a Native American specific loan program.CRAFT3 is on site at the City of Tacoma’s Offices by appointment.

Website: www.craft3.org

Ventures

Business Builder Loans are loans designed for startups, existing businesses, or purchasing an established business. Loan amounts range from $5,001 to $35,000.

Contact: 206.352.1945 or [email protected]

Address: 2100 24th Ave S., Suite 380, Seattle, WA 98144

Website: http://venturesnonprofit.org/

My Checklist

Contract with the city

Contracting Opportunities

The City of Tacoma invites qualified vendors to submit bids and proposals for posted projects. Solicitations are posted on the City’s Purchasing website and are open to all interested parties. Formal, sealed solicitations are advertised in the Tacoma Daily Index, the City of Tacoma’s official legal publication.

- Supplies Solicitations

- Services Solicitations

- Public Works and Improvements Solicitations

- Small Works Solicitations

- Surplus Solicitations

To learn more about contracting opportunities and understand the process, visit this page. To receive notification from the City regarding potential amendments or other updates to the original solicitation document(s), prospective bidders and proposers must register at this website for each solicitation of interest. All registration information must be accurate, complete and current. If you fail to register or provide the required information, you will not be notified of possible amendments or updates. In the absence of valid registration, the City shall not, under any circumstances, be responsible or liable for guaranteeing that such amendments and/or updates will be made available to you by other means. You are directed to periodically visit this website to obtain current information.

For questions about contracting with the City of Tacoma please contact the Purchasing Office at (253) 502-8468. The Purchasing Office is located on the main floor of the Tacoma Public Utilities Administration Building North at 3628 South 35th Street, Tacoma, WA 98409.

My Checklist

Choosing A Location

The City of Tacoma Planning and Development Services Department (Tacoma Permits or 253-591-5030) can help provide guidance with opening your business property to avoid surprises. is the responsibility of each business owner to be in full compliance whether or not the information is included in this site. During the Covid19 Municipal Building closure, the Planning and Development Services Department offers free land use guidance during business hours by phone, email, or scheduled virtual appointment. (Please visit this web page for further information on how to contact the department.) If your preferred location allows your type of restaurant, we recommend hiring a designer/architect who can prepare your permit plans. Some locations in the City have land use and zoning restrictions that don’t allow restaurants or a particular type of restaurant. Most establishments are categorized as “Restaurant” or “Drinking Establishment,” while some may involve food or drink production. If your location is near the waterfront or in a historic district or building, you may need a land use approval before the City can issue a building permit. Don’t sign a lease before knowing if your preferred location is suitable for your type of operation.

Serving Alcohol

If you are planning to produce, serve, or sell alcohol, make sure you know which use classification in the zoning code fits your business and that you have the appropriate permits and licenses. For example, a “drinking establishment” (taverns, bars, pubs, or cocktail lounges, etc.) generally has an age restriction and is only allowed in certain zoning districts with a conditional use permit. This is different from a “restaurant” that primarily serves food but may offer alcohol (cafés, eateries, bistros, diners, restaurants, sandwich shops, etc.). Producing alcohol also means your use would be associated with “craft production” as a brewery, winery, brewpub, or craft distillery. Serving alcohol requires a liquor license – 60-90 days for approval, and both the location and applicant must meet the criteria for obtaining a liquor license. Be sure you have a liquor license from the Washington State Liquor and Cannabis Board.

More information: City of Tacoma, Planning and Development Services | www.tacomapermits.org (253) 591-5030 To request this information in an alternative format or a reasonable accommodation, please call 253-591-5030 (voice). TTY or STS users please dial 711 to connect to Washington Relay Services. RESTAURANTS AND FOOD SERVICE G-105, 1/2015 alcohol production, sale, or service. More information is available at http://www.liq.wa.gov/licensing/applyliquor-license.

Web & Social Best Practices for Small Businesses

Social Media and Web Introduction Guide for Small Business.

The Economic Development Board for Tacoma-Pierce County, Pierce County and City of Tacoma created a “beginners guide” to social media and eCommerce to help businesses reach customers. From posting times and delivery options to geotags and hashtags, the guide offers what you need to get started and find new ways to connect with customers looking to shop local.

INSIDE THIS GUIDE

- Introduction

- COVID-19

- Social Media at a Glance

- Posting Times & Demographics

- Information Guides

- Geotags & Hashtags

- Delivery Services

- Mailing 101

- Web Development

- Alternatives to Websites

- Customer Engagement

- Best Practices

- Productivity Ideas